How to avoid Cash App scams

The best ways to avoid Cash App scams are by using the app responsibly, staying alert, and knowing what to look out for. But even with your best intentions, a hacker may find a new way to slip malware on your phone through a Cash App scam — always make sure you have a quality free antivirus on all your devices to keep them safe.

Like Venmo, Zelle, and other payment apps, Cash App is generally safe for transactions with trusted individuals. But unlike debit card transactions, P2P payments lack robust fraud protections, which makes falling for Cash App scams particularly dangerous.

Here are some guiding principles to help you steer clear of Cash App scams:

Don't exchange payments with a random person

Cash App is safe for splitting bills and paying for one-time services or even large transactions for people you know personally. Any transactions with those you don’t know personally leave you open to manipulation. When dealing with businesses, make sure to double-check for typos, alternate spellings, or letter-swapping tricks (such as using an upper-case “i” instead of a lower-case “L”).

Don’t share your personal details online

Be careful what you share online, especially when it’s not on a private account. A scammer doesn’t need a lot to send you a convincing fake email, SMS, or DM, then move the scam to Cash App. Any online personal details can also be gathered to scam you in the future, or they can be sold to data brokers.

And never share your Cash App PIN or any other account details online, even if you receive an official-looking email or message. Cash App will never ask you for your PIN or sign-in code.

Don’t give out personal information to strangers. Use privacy settings on all your accounts to help protect you from Cash App scammers.

Don’t give out personal information to strangers. Use privacy settings on all your accounts to help protect you from Cash App scammers.

Review your bank account statement regularly

Check your bank account and Cash App transactions regularly for any suspicious activity. Review your credit report occasionally for discrepancies, too.

If you suspect identity theft, set up a fraud alert on your credit report to put the relevant agencies on notice. Then use a free tool like Avast Hack Check, which is included with our private browser, to see if any of your passwords have been exposed in a data breach. If compromised, update your passwords immediately to protect your accounts.

Avast Secure Browser also allows you to browse, chat, and shop securely online without constantly worrying about digital threats. It’s like an invisible shield — it hides everything you type online, protecting sensitive data like passwords and credit card numbers.

Don’t click suspicious links

Cash App scams often involve links to unsecured websites made to look legit. Or they can lead to malware that steals data and spies on you. Clicking suspicious links can drain your wallet, damage your device, or send you to the dark corners of the internet. Our website safety check guide can teach you the warning signs to watch out for.

Use strong, unique passwords

If you use the same password for multiple accounts, and scammers get their hands on it, they could use it against you in a Cash App scam, a Venmo scam, or another type of financial fraud.

Always create strong, unique passwords for all your accounts. Weak passwords consist of anything that can be found online about you, including your distant past. Use one of the best password managers to help keep all your passwords safe.

Use two-factor authentication

Two-factor authentication (2FA) requires two forms of verification before letting you into an account. If it’s not set up on your Cash App account, make sure you use it. Cash App will help keep you secure by sending you a one-time password every time you sign in.

Biometric data and using facial recognition technology like Apple’s Face ID can also help secure your phone and accounts. There are also dedicated verification apps you can use like Google Authenticator.

Use two-factor authentication (2FA) to keep your online accounts more secure.

Use two-factor authentication (2FA) to keep your online accounts more secure.

Turn on alert settings

You can turn on notifications for all Cash App transactions to track account activity wherever you are. If someone is trying to access your funds, you’ll know right away. To activate notifications, open Cash App > tap your profile icon > Notifications and select which ones you would like to activate.

Popular Cash App scams

Popular Cash App scams include fake refunds, screenshot scams, and phishing. Most Cash App scammers use social engineering to trick their targets into giving up sensitive details or performing unsafe actions.

1. Impersonating customer support

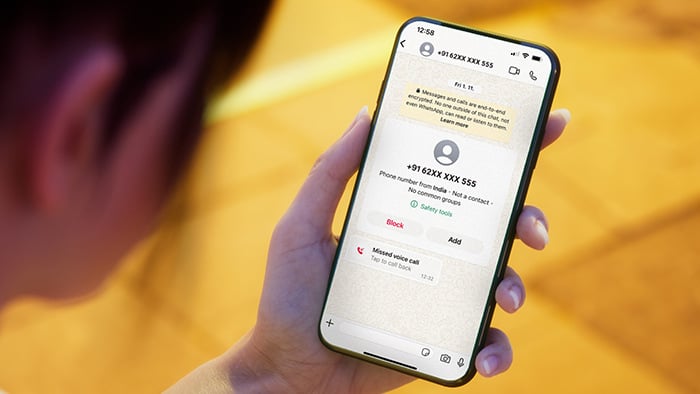

Similar to tech support scams, scammers could contact you via phone, text message, DM, or email, pretending to work for Cash App. They’ll try to get your Cash App passcode and one-time password to gain access to your account.

Customer support scammers can be convincing because they often spoof the Cash App number or name. Communicate with Cash App only through the app itself, by calling the number from their official website, or using the official Cash App support site.

2. Selling expensive items

Cash App offers business accounts for small businesses to sell goods and services. Scammers may open a fake Cash App account and get you to pay for a great “deal” on a desirable item, such as concert tickets or rare collectibles. Then, after you pay, they’ll stop responding.

Cash App scammers often use high-value expenses like rental deposits to lure victims. They create fake property listings with enticing prices and pressure you to send a deposit via Cash App — then disappear. While a low price isn’t always a scam, always visit the property in person and use a more secure payment method like a bank transfer.

To stay safe from Cash App business account scams, make purchases only from established retailers or those you know personally.

3. Accidental transfers

A common trick Cash App scammers use is sending “accidental” transfers from stolen credit cards or hacked accounts to their victims. The victim is then asked to send the money back to the scammer’s fake Cash App account. The “accidental” transfer is then also soon reversed by the other scammed victim’s bank and the scammer disappears with your money.

If someone sends you money on Cash App randomly, don’t respond to any messages about returning it. Report the scam directly to Cash App.

4. Bitcoin and other cryptocurrency schemes

Cryptocurrency is a common target of Cash App scams since it’s largely anonymous and nearly impossible to recover. And since Bitcoin is arguably the most well-known cryptocurrency, Bitcoin scams are especially common, with fraudsters promising huge returns for a small investment — only for victims to lose all their money. Crypto scammers also use hacked social media accounts to trick friends into sending crypto before the fraud is detected.

5. Cash flipping

Cash flipping scams, also known as money circle scams, are a cybercrime version of real-world pyramid schemes. The scheme may promise to double or quadruple your money by investing it in the stock market through a friend or professional contact. But just like pyramid schemes, they’re designed to scam people out of their money.

Cash App users can be targeted directly on Cash App, on a social media platform, or by SMS. Scammers sometimes post details of these money-making schemes on social media and wait for interested people to take the bait. They then ask them to send money through Cash App.

6. Cash App Friday Scams

Cash App previously ran a #CashAppFriday promotion that went viral on Twitter and Instagram, where anyone who followed or commented with their $Cashtag was entered in a cash giveaway. Scammers have exploited its popularity to run fake Cash App Friday promotions. Everyone who enters the “contest” is messaged saying they’ve won — they just have to pay a fee or enter banking details to claim their “prize.”

Cash App has since shied away from Cash App Fridays, but the company often runs similar promotions with gift cards, Bitcoin, and other prizes. If you want to know if a Cash App giveaway is real, confirm it’s a verified Cash App account first, and never pay someone a fee to receive money.

7. Phishing, vishing and smishing

Phishing is how scammers get you to give up your details or click dangerous links in a fake email, while vishing works through voice calls and smishing through SMS. There are also platform-specific scams such as Apple ID phishing scams.

These Cash App scams involve scammers impersonating authority figures, businesses, colleagues, and the like. The aim is to trick you into handing over sensitive info, such as your login details, or opening links that trick you into doing the same.

A common Cash App phishing scam involves fake surveys. Scammers pose as legitimate companies, offering rewards for completing a survey. But before you can begin, they request sensitive information like your Social Security number or an upfront payment, which legitimate surveys will never do. Learn how to identify fake texts to help avoid a sham giveaway.

Cash App scammers can impersonate a trusted organization via the phone, email, or text.

Cash App scammers can impersonate a trusted organization via the phone, email, or text.

8. Romance scams

Romance scams come in many forms, but the premise is always the same: hook lonely or desperate people into sending money in exchange for a love that will never be. A romance scammer typically scouts a target before making their move.

Catfishers use a fake online persona and pretend to be a potential mate for their victim. They dangle the prospect of meeting in person, but a problem always comes up that supposedly only a Cash App transfer or payment can fix, such as money to buy a plane ticket. Romance scammers will drain their dupes as much as possible before cutting them loose.

9. Screenshot scam

Cash App screenshot scams are when Cash App scammers send fake screenshots “proving” that a payment is pending, an investment you made has turned into big money, that you’ve won a prize, or some other alleged win. They will then ask you to send them money back for some reason, such as claiming that the total they “sent” you was incorrect.

In a version of gift card scams, they might ask you to refund them through gift cards instead of Cash App. When requesting money, Cash App scammers sometimes ask you for a screenshot of your payment as well. This screenshot could then be used as “proof of payment” for other people the scammer is scamming.

10. Government scams

Another form of Cash App fraud involves scammers impersonating the government, claiming to send you a tax refund, relief, or other stipends. They may ask for your Social Security number or Cash App details to "process" the payment, or they might demand you pay a fee via Cash App before releasing the funds.

No government agency will ever contact you through Cash App, or ask you to send money through a payment app. Communicate with government agencies only through official channels.

I think I've been scammed, what do I do?

If you think you've been scammed on Cash App, contact Cash App support and report the transaction immediately. Then, change your account details, including your PIN. For further protection, contact your bank or credit card provider, and file a fraud report with the authorities.

Report and block the account

To report a scam to Cash App, call their support line at 1-800-969-1940 or start a chat via the app.

Here’s how to block a Cash App account:

-

Tap the Activity tab on the home screen.

-

Tap the scammer’s name.

-

Tap Block at the bottom of their profile.

Change your Cash App account details

If you think a scammer has any of your details, immediately change your login information and PIN. Add 2FA settings if you haven’t done so. Also, consider transferring your balance to your bank account.

Contact your bank

If you can prove Cash App fraud took place, your bank may be able to recover the funds. However, most banks don’t cover Cash App or other money apps in their policies, and even if they do, getting proof of a crime can be difficult.

Contact the Federal Trade Commission

You can report a mobile payment app scam to the FTC if you think you’ve been a victim of a Cash App crime. You should always report any internet scam you come across to help stop others from being scammed.

Will Cash App refund money if I'm scammed?

There’s no guarantee you’ll be refunded if scammed through Cash App, though banks may reverse charges in specific cases. Credit card users have chargeback rights for fraudulent purchases, but there are no such guarantees for Cash App fraud.

Cash App may be able to cancel a transaction if you notify them immediately. But once you send payment, and especially if it gets to the scammer’s account, it’s likely gone forever.

Unless you’re dealing with friends and family, it’s best to send money through secure channels with advanced security features. In any case, you should use one of the best secure browsers for extra privacy whether you’re using Cash App, shopping online, or sending any other secure information online.

Shop and bank securely with Avast Secure Browser

Help keep your financial transactions safe with Avast Secure Browser and benefit from advanced security features designed to shield your passwords, personal info, and banking details. Activate Bank Mode with one click for extra protection, and let our built-in anti-phishing technology automatically block harmful websites and downloads. Download it now for secure, stress-free online banking and shopping.